Issue, No.1 (March 2017)

Is redistribution in South Korea really so small?

The difference in inequality (as measured by the Gini index) of market income versus inequality of disposable income is often used as a measure of the redistributive impact of social security and direct taxation systems in a country. Typically, high income countries tend to exhibit a redistribution effect larger than middle or lower income countries. This goes hand in hand with the development of the social security and taxation systems, which tend to be more developed in high income countries.

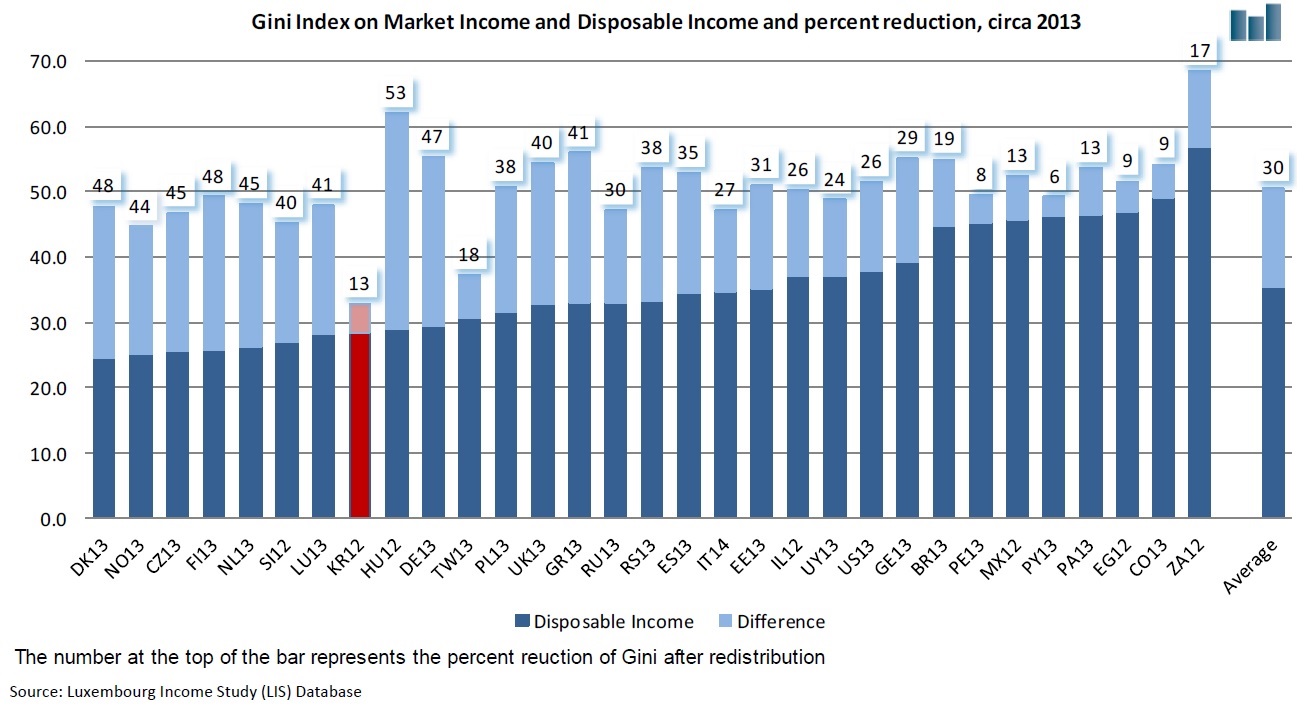

South Korea is often highlighted as being an outlier with respect to this, as the difference in Gini between market and disposable income is almost one fourth of the average difference in OECD countries (cf. OECD 2016). The 2012 microdata from South Korea, recently uploaded in the LIS Database, confirm this picture: the percentage reduction in Gini, when going from market income to disposable income, amounts to only 13 per cent, whereas it lies at around 40 per cent for most high income countries included in Wave IX of the LIS Database (see figure below). This low redistributive effect is more similar to that of the Latin American countries included in the LIS database, as well as South Africa and Egypt.

But differently from those middle income countries (and similarly to Taiwan, another Asian tiger economy), this low redistributive effect is associated with a very low level of inequality of primary income (with a Gini on market income just above 30, as against Gini levels of about 50 in both middle and high income countries). As a result, inequality on disposable income is rather low, also when compared to other high income countries.

While this finding is rather common across the literature, it should be noted that the South Korean data stand out with respect to other LIS countries also in other aspects. More precisely, among the LIS countries for which income taxes and social security contribution figures are available in the microdata, South Korea is the one with the lowest rate of taxes and contributions as a percentage of total gross income (with a total ratio of 8 per cent, even lower than in Latin American countries). This finding seems not to be in line with the level of tax and contributions rates in South Korea.

In addition, when comparing the results of the microdata inflated to the total population with corresponding aggregated amounts from the National Accounts, it turns out that the coverage rate of both taxes and social security benefits calculated from the microdata is among the lowest of all datasets included in the LIS Database: direct taxes captured in the survey reflect less than 40% of the corresponding figure from the National Accounts (which is the lowest ratio in the LIS Database), while the LIS to National Accounts ratio of social security benefits amounts to less than 50% in 2012 for South Korea, when it lies in the range of 70 to 90% for most other countries (cf. Endeweld and Alkemade 2014).

Altogether, these findings suggest that the effect of redistribution of taxation and benefits is in fact larger than what is generally shown based on microdata. This note points to the need of further investigating the causes underlying the peculiarity of South Korean data compared to other high income countries when it comes to the magnitude of redistribution. Taking into account the impact of indirect taxation might shed some further light on the overall size of redistribution in South Korea.

References

| Endeweld, M., and Alkemade, P. (2014). LIS Micro-Data and National Accounts Macro-Data Comparison: Findings from wave I – wave VIII, LIS Technical working papers series – No. 7, Apr – 2014. |

| OECD (2016). OECD Inequality Update 2016 – Income inequality remains high in the face of weak recovery – 24 November 2016.. |